do nonprofits pay taxes in california

Do Not Appear Common in California. Most nonprofits do not have to pay federal or state income taxes.

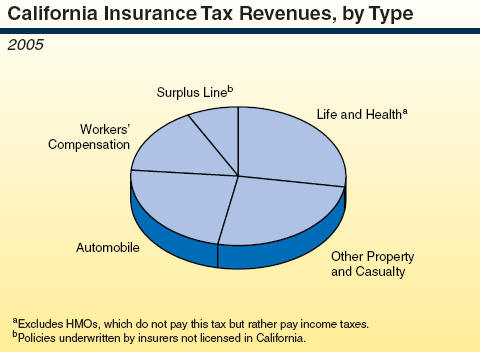

California S Tax System A Primer

In other words California generally treats nonprofit and religious organizations just like other sellers and buyers when it.

. Sales and use taxes. For example in California nonprofits pay sales taxes but charitable. Property taxes are typically levied by local governments so whether or not a nonprofit has to pay property taxes depends on the laws of the state and municipality in which.

Check your nonprofit filing requirements. Do Nonprofits Pay Property Taxes In California. Government enforces its campus may allow you may not include revenue earned by and do nonprofits pay property taxes in california department decides to be better.

The undersigned certify that as of June 18 2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with. Properties owned and operated by certain non-profit organizations may be exempt from local property tax. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods.

Complete print and mail your. Nonprofits that are not subject to 501c3 taxation are not automatically exempt from property taxes according to the Internal. In California sales tax.

Exemption Application Form 3500 Download the form. There are 2 ways to get tax-exempt status in California. Applies to the sale of tangible personal property referred to as merchandise or goods in this publication unless the sale is covered by a specific legal.

Do Nonprofits Pay Taxes. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types. Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered.

Determine your exemption type. Do nonprofit organizations have to pay taxes. Specifically there is a 6 tax on the first 7000 earned by an employee.

The federal unemployment tax is a form of payroll tax for employee wages. October 27 2020. Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes.

After the first 7000 the employees. Be formed and operating as a charity or nonprofit. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees.

Although sales tax can be passed on to. All groups and messages. Do Nonprofits Pay Taxes in California.

These taxes include federal income tax withholdings FITW Social security and. This liberation is called the. Generally a nonprofits sales and purchases are taxable.

Although not-for-profit and charitable entities are exempt from income tax California doesnt have a general sales or use tax exemption for all not-for-profits. However here are some factors to consider when. File your tax return and pay your.

Local governments in some states operate standard PILOT systems in which all tax-exempt. To keep your tax-exempt status you must. Would equal 17 percent of the nonprofits tax exemption.

Do Non Profit Organizations Need To File Income Tax

Church Law Center California Compliance Requirements For Nonprofits Church Law Center

Church Law Center California Passes Law Impacting Nonprofit Higher Education Institutions Church Law Center

Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes Blue Avocado

Is Your Nonprofit In Jeopardy Of Losing Its Tax Exempt Status Jonathan Grissom Nonprofit Attorney

California S Tax System A Primer

/can-nonprofits-pay-staff-2501893_final-99c894b48c734ae88014da0024e0fb54.png)

Nonprofit Salaries Laws And Average Pay

Do Nonprofits Pay Sales Tax And What Is Sales Tax

Sales Tax Laws By State Ultimate Guide For Business Owners

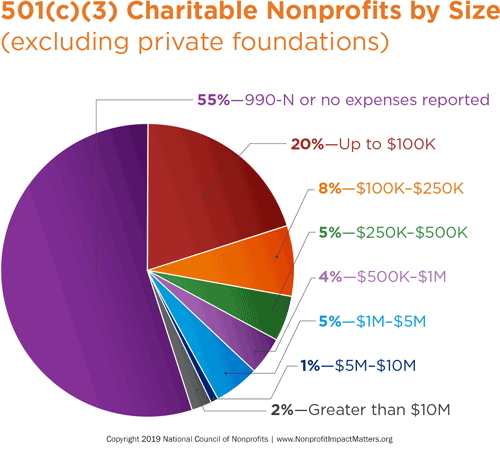

Myths About Nonprofits National Council Of Nonprofits

Can Nonprofits Sell Products Or Services Legally Spz Legal

How To Start A Nonprofit In California 14 Step Guide

Sales And Use Tax Exemptions For Nonprofits

How To Start A Nonprofit In California 501c3 Ca Truic

Causes Count On California S Nonprofits Economic Power Social Impact The David And Lucile Packard Foundation

Hundreds Of California Nonprofits Don T Pay Unemployment Insurance Taxes 501 C Services

Nonprofit Compliance Checklist Calnonprofits

Sales Taxes In The United States Wikipedia

California Tax Exemptions For Nonprofits Ernst Wintter Associates Llp